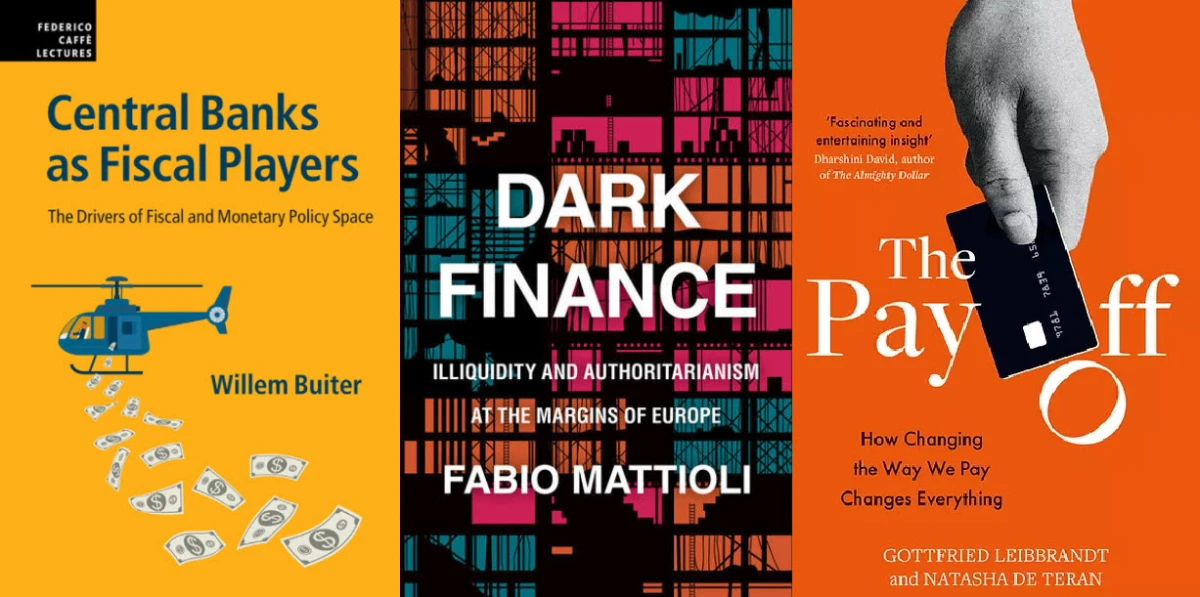

Last autumn I reviewed three books that highlighted different perspectives on money, finance, and central banking that deserve closer attention.

In the first book, Gottfried Leibbrandt and Natasha de Teran point out that the main reason to have money is to make payments – which means that when you start to change the payments system, you wind up changing just about everything connected to money. That ‘wallet’ on your cell phone is only the tip of the iceberg.

In the second book, Fabio Mattioli explains that when we talk about finance, we are primarily talking about forward looking contracts – and those contracts are only as good as their enforcement. By implication, a financialized economy looks very different when politicians start deciding which contracts will be honoured and which will not. Any debate about ‘rule of law’ goes to the heart of the financial economy.

In the third book, Willem Buiter reminds us that the central bank is a public asset owned by the national state. If national governments accounted for that asset in their balance sheets, they would uncover important revenue streams that could stimulate the economy and reduced burdens on taxpayers. The ‘helicopter money’ that policymakers talked about both during the global economic and financial crisis and at the start of the pandemic is not as strange or uncommon as you might think.

***

Continue reading →